Insights

Featured Insights

No results found.

All Insights

Content Type:

- All

- AML and Compliance News

- Article

- Audio

- Audiocast

- Careers

- Case Study

- E Book

- E-Book

- Event

- Financial Reporting Insights

- Guide

- Infographic

- Insight Article

- Live Webcast

- Monthly Market Commentary

- Muse

- News Release

- Newsletter

- On Demand Webcast

- Outlook

- Perspective

- Real Economy Blog

- Recorded Webcast

- Research

- Senior Living Health Care Connection

- Special Report

- Tax Alert

- Tax Blog

- The Real Economy

- Video

- Virtual event

- White Paper

Industry:

- All

- Asset management

- Automotive

- Brokerage and Trading

- Business and Professional Services

- Business Services

- Colleges and Universities

- Construction

- Consumer Goods

- Consumer Products

- Education

- Energy

- Financial Institutions

- Financial Services

- Fintech

- Food and Beverage

- Food Beverage

- Fund Services

- Gaming

- Government

- Government Contracting

- Government Public Sector

- Health Care

- Healthcare

- Hedge Funds

- HIPAA HITECH Compliance

- Hospitality

- Hospitals and Health Systems

- Insurance Industry

- Life Sciences

- Long Term Care

- Manufacturing

- Media & Entertainment

- Nonprofit

- Portfolio Services

- Private Clubs

- Private Equity

- Professional Services

- Real Estate

- Real Estate Construction

- Real Estate Funds

- REITS

- Restaurant

- Retail

- Specialty Finance

- State and Local

- Tech Media Telecom

- Technology Companies

- Technology Industry

- Telecommunications

- Tribal Gaming

Service:

- All

- Accounting

- Audit

- Auditing

- Business Applications

- Business Process Outsourcing

- Business Strategy

- Business Tax

- Business Transformation and Improvement

- Business Valuation

- Cloud Computing

- Compensation and Benefits

- Consulting

- Credits and Incentives

- Cybersecurity Risk

- Data and Analytics

- Digital Transformation

- Due Diligence

- Employee Benefit Plans

- Employer Benefits

- Enterprise and Strategy Risk

- ERP and CRM

- Family Office Services

- Federal Tax

- Finance and Accounting

- Financial Advisory

- Financial Consulting

- Financial Investigations

- Financial Management

- Financial Reporting Resource Center

- Global Audit

- Global Compliance and Reporting

- Global Services

- Governance, Risk and Compliance and Enterprise Risk Management

- Indirect Tax

- Infrastructure

- Internal Audit

- International Services

- International Tax Planning

- Investment Advisory

- IPO Readiness

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Mgmt Cons Archives

- PCAOB

- People and Organization

- Private Client

- Private Client Services

- Public Companies

- Regulatory Compliance

- Retirement Plan Advisory

- Risk Advisory

- Risk Consulting

- Sarbanes-Oxley Advisory

- SEC

- Security and Privacy

- Service Organization Control Assurance

- State and Local Tax

- Strategy and Management Consulting

- Strategy Execution

- Tax

- Tax Function Optimization

- Technical Accounting Consulting

- Technology and Digital

- Technology Consulting

- Technology Risk

- Trade Advisory Services

- Transaction Advisory

- Washington National Tax

- Wealth Management

Topic:

- All

- Affordable Care Act

- AICPA Matters

- Anti-money Laundering

- Apportionment

- Artificial Intelligence

- ASC 842

- Automation

- Base Erosion and Profit Shifting (BEPS)

- Blockchain

- Board Insights

- Bonus Depreciation

- Brexit

- Business Growth

- Buying Patterns

- Capital

- Career Blog

- CARES Act

- CECL

- Coronavirus

- Covid-19

- Credit impairment

- Cryptocurrency

- Customer Experience

- Cybersecurity

- Cybersecurity and Data Breach

- Data Analytics

- Digital Assets

- Digital Evolution

- Digital Goods

- Digital Transformation

- Distressed Real Estate

- Economics

- Election 2020

- Employee

- Employee Benefit Plan Services

- Employee Benefit Plans

- Employee Benefits

- Enviromental Social Governance ESG

- ESG

- Exempt Organizations

- FATCA

- Financial Reporting

- Fund Management

- Global

- Global Compliance

- Global Expansion

- Going public

- IFRS

- Inflation

- Innovation

- International Standards

- Labor and Workforce

- Lease Accounting

- Leases

- Management Consulting Blog

- Nexus

- Online and Remote Seller Sales Tax

- Operations

- Organic

- Owner

- Partnership

- Payroll and Employment

- PCAOB Matters

- People

- Policy

- Recent accounting updates

- Regulations and Compliance

- Regulatory Compliance

- Revenue recognition

- Risk and Opportunity

- Risk Management

- S Corporation

- SALT Compliance

- SEC Matters

- SPAC Special purpose acquisition companies

- State Tax Nexus

- Succession Planning

- Supply Chain

- Tax Base

- Tax Reform

- Technology and Data

- Trade and Tariffs

- Vendor Third Party

Reflections from 2022 and a look forward for the health care industry

As the calendar year wraps, it's time for health care organizations to reflect on challenges this year as well as what to focus on for the coming year.

4 ways nonprofits can drive mission impact

Learn four key strategies that can help nonprofit organizations enhance their effectiveness and increase their mission impact.

The rising uniformity of multifamily housing

The standardization of multifamily building design and construction across U.S. cities has resulted in the homogenizing of America.

Frequently asked questions about stock appreciation rights

Stock appreciation rights are an equity-based compensation device intended to incentivize key employees.

FASB proposes guidance on accounting for joint venture formations

The FASB is consulting on the accounting for a joint venture in the separate financial statements of the joint venture.

IRS limits adequate disclosure penalty protection in exam

Revenue Procedure 2022-39 updates procedures for certain large taxpayers to avoid imposition of accuracy-related penalties by making an adequate disclosure early on in an IRS examination.

Financial conditions update: Rising risks and tightening markets

Despite a strong bounce in U.S. financial markets following better-than-anticipated inflation data for October, financial conditions remain tight.

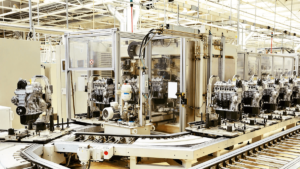

RSM US Supply Chain Index returns to pre-pandemic level

Our RSM US Supply Chain Index pointed to supply efficiency for the fourth month in a row, reaching 0.49 standard deviations above neutral in October.

Retail sales surge, easing recession fears for now

Retail sales data surged in October as holiday shopping started early for the second year in a row.

Where are you in your going public journey?

If an IPO is in your future, take our quick IPO readiness quiz which covers the most important considerations—some you may not have given much thought to yet.

Private equity investment a bright spot for tech, media, telecom companies

Despite the overall decline in venture capital and private corporate M&A activity, the middle market TMT sectors have remained relatively resilient.

Health care revenue integrity: Panel shares insights and considerations

Health care leaders share revenue integrity challenges and insights at RSM’s Virtual Health Care Day.

Uncertainty, policy choices and the prospects for middle market investment

Stubbornly high inflation and rising interest rates are creating a pervasive sense of uncertainty among business owners and investors that has left policymakers with few good options.

Consumer products holiday season insights: Retail holiday shopping expected to be strong this year

The holiday shopping season is expected to continue to show strong nominal spending by consumers.

October data: Manufacturing jobs show little sign of slowing, but openings still elevated

After three months of softening manufacturing payroll data, hiring continued and experienced an uptick in October, according to Bureau of Labor Statistics data released Friday.