Insights

Being deemed essential doesn't preclude ERTC eligibility

ARTICLE | September 21, 2021

Authored by RSM US LLP

Despite receipt of PPP loans, construction firms may be eligible

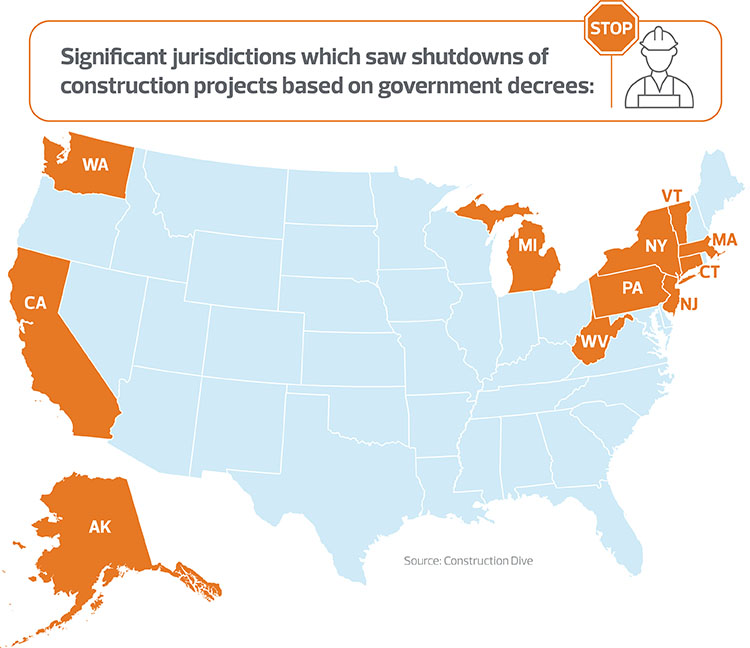

The construction ecosystem has not been immune to the COVID-19 pandemic. In March 2020, as world leaders were trying to figure out how to prevent the continued spread of COVID-19, many states and local governments deemed some forms of construction to be an essential service that could continue with appropriate protections in place. However, several states and municipalities took a conservative approach to shut down construction sites altogether until more was known about the spread of the virus, affecting many businesses in those states and municipalities.

By mid-May, most states and municipalities had reopened their construction sites, but the impact was felt by the industry with declines in total construction employment of 14% in April 2020 and declines in total construction spend of 5% in May 2020, both of which rebounded throughout the summer. One of the leading factors of the rebound was the provisions within the CARES (Coronavirus Aid, Relief and Economic Security) Act, in particular, the PPP (Paycheck Protection Program). The construction industry was the third-largest sector to utilize the PPP from the initial round of funding, accounting for 12.38% of total PPP loans as of June 30, 2020. Construction companies considered the Employee Retention Credit, also known as the employee retention tax credit or ERTC; however, in accordance with the CARES Act, PPP loan recipients were ineligible for the ERTC, limiting availability of use.

This changed in December 2020, as Congress passed the CAA (Consolidated Appropriations Act), expanding ERC benefits to more employers retroactively to 2020 and extending the benefits of these provisions into the first two quarters of 2021. Congress has subsequently extended the credit again through Dec. 31, 2021, in the ARP (American Rescue Plan) passed earlier in March.

One of the main provisions was the retroactive ERTC eligibility for employers who had received PPP loans in 2020. Employers with qualified wages paid beyond those required for PPP forgiveness or certain other credits are eligible to apply those wages to the retention credit retroactively for the 2020 tax year, expanding the use cases for the ERTC and the construction industry.

Eligibility requirements for the ERTC

To meet the eligibility qualifications for the ERTC, an employer must show either:

- An employer fully or partially closed or was otherwise more than nominally affected as a result of government orders or mandates.

- An employer suffered a 50% or 20% decline in gross receipts for a quarter(s) in 2020 or 2021, respectively, as compared to the same quarter(s) in 2019.

Under the governmental order qualifications, an employer must be able to show that a governmental order at the federal, state or local level affected the operation of the employer’s trade or business by limiting commerce, travel or group meetings. Any construction employer forced to close, reduce or cancel operations by jurisdictional order that is a normal source of business may meet this requirement if they also paid some of the furloughed employees’ health benefits, or if they paid employees for hours in which they could not work because of closures, reductions, etc. Those construction companies that were deemed essential that voluntarily closed, or that were otherwise not forced to close under orders have a higher burden to prove the applicability of governmental orders on their businesses, but may still be able to qualify for the ERTC. It is important to note that a mere reduction in business due to the overall economy is not sufficient to meet the requirement.

Each employer’s situation will likely vary as a result of businesses’ location, jurisdictional orders affecting the construction job sites and economic impacts in the relevant periods. As governmental orders varied from jurisdiction to jurisdiction, employers need to consider the eligibility requirements in light of the facts and circumstances in place for each period, location and their organization as a whole.

Note: The map is not all inclusive so it is important to ensure that local mandates were in place for any employers looking to qualify under this eligibility requirement).

Alternatively, an employer can also qualify for the ERTC by showing a reduction in gross receipts for a quarter in any of the eligible periods as compared to 2019 levels. If an employer can show the aggregated gross receipts for a quarter in 2020 and/or 2021, are 50% or less and 20% or less, respectively, than the same quarter in 2019 (for 2021 gross receipts, an employer can elect to use the previous quarter), they are eligible for the ERTC.

Based on the current status of the industry and many construction companies being able to proceed with work, as well as historic backlogs heading into the pandemic, most construction companies have been eligible under the governmental order guidelines identified above, rather than the gross receipts eligibility guidelines. While this may not be the case for all construction companies as those servicing certain industries (like hospitality or retail) may have seen declines in gross receipts, it is likely that most companies in the industry have not seen significant enough declines to be able to qualify under the gross receipts threshold.

It should also be noted that in determining the eligible employer for the gross receipts test and total employee number for the determination of qualified wages, an employer must aggregate all related companies.

Other considerations

Beyond the ERTC, employers may want to consider a number of additional factors before claiming the credit, such as mechanisms to maximize qualified eligible wages. An employer cannot use the same wages for the ERTC as used for the PPP loan forgiveness or certain other credits, such as the work opportunity credit (WOTC). An employer should review potential eligible periods and wages for ERTC, PPP and other credits to develop a method that results in the best use of wages for each eligible period. These companies may also consider health care expenses. Ultimately, if the employer finds the above analysis still yields insufficient wages, PPP full dollar forgiveness would often be more attractive than a partial retention credit for the wages in question.

One final note for an employer considering retroactive application of the ERTC is that 2020 income tax returns may require an extension for the necessary due diligence to document eligible wages for ERC. The retroactive 2020 ERTC requires filing an amended Form 941-X. An employer should exclude any ERTC amount filed on the Forms 941 or 941-X from its wage deduction on the 2020 income tax return. Employers’ likely need to extend the 2020 tax return to reflect a proper income tax filing either by waiting until calculating the final number or by filing a superseded return with the final number.

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Nick Grandy and originally appeared on Sep 21, 2021.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/construction/being-deemed-essential-doesnt-preclude-ertc-eligibility.html

The information contained herein is general in nature and based on authorities that are subject to change. RSM US LLP guarantees neither the accuracy nor completeness of any information and is not responsible for any errors or omissions, or for results obtained by others as a result of reliance upon such information. RSM US LLP assumes no obligation to inform the reader of any changes in tax laws or other factors that could affect information contained herein. This publication does not, and is not intended to, provide legal, tax or accounting advice, and readers should consult their tax advisors concerning the application of tax laws to their particular situations. This analysis is not tax advice and is not intended or written to be used, and cannot be used, for purposes of avoiding tax penalties that may be imposed on any taxpayer.

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.