Insights

Conditions ripe for strategic real estate, construction investments

ARTICLE | February 14, 2021

Authored by RSM US LLP

Historically low interest rates are providing a rare opportunity for many businesses in the pandemic-depressed economy to access low-cost capital and make long-term strategic investments in technology and other improvements such as upgrades to their facilities, writes RSM US Chief Economist Joe Brusuelas.

Real estate is no exception.

Real estate opportunities

Commercial real estate and construction are undergoing significant transformation due to the pandemic; these industries cannot afford to sit by on the investment sidelines, even as many face margin pressures and reduced cash flows and liquidity.

From office buildings to industrial sites, inexpensive capital affords real estate operators and investors the chance to get ahead in what promises to be a hypercompetitive post-pandemic environment.

Building improvements

- Pandemic protocols: New safety standards for office buildings, factories, hotels, hospitals and other commercial properties call for the installation of touchless technologies, new equipment like high-performance HVAC and sanitation systems, and significant reconfiguration of space to meet social distancing protocols, among other changes.

- Green initiatives: The United States has rejoined the Paris Agreement, and the Biden administration is quickly rolling out plans for U.S. carbon reduction and other sustainability measures. Green financing incentives allow businesses to advance sustainability goals such as energy and water reduction, use of environmentally friendly materials and related measures.

- Repurposing space: The shortage of affordable housing in major cities such as New York and San Francisco provides opportunities to improve cityscapes by building on vacant sites. Meanwhile, as airports, hotels and retail spaces experience a decline in use, new opportunities such as mixed-use properties are coming to the fore.

Technology investment

- Data analytics: Improved data analysis is helping early adopters to better weather pandemic headwinds and identify new deals in the rapidly changing real estate landscape. The lower cost of capital is offering real estate companies the chance to catch up on technologies such as artificial intelligence, machine learning and cloud-based solutions, while mitigating the financial burden associated with digital transformation.

Refinancing

- Industrial and multifamily: Many property owners have looming debt maturities approaching and may have been unable to meet covenants amid revenue shortfalls and other pandemic-related constraints. Not all sectors will be able to benefit from lower financing rates, but industrial and multifamily are receiving more favorable terms, and assets in those classes may be ripe for refinancing. Lenders, however, have tighter lending standards and require additional risk-mitigation measures such as additional up-front reserves.

Portfolio investment

- Diversification: Longer term, low interest rates and more affordable capital may lead to improving valuations in some depressed pockets of the United States. This will create opportunities for real estate funds with excess dry powder to explore assets beyond their traditional core groups, as lower return-on-investment thresholds may still yield profits. This trend is already playing out with some traditional hotel- and retail-specific funds that are pushing to diversify into life sciences, data infrastructure and cold storage warehousing, to name a few.

Construction opportunity

Technology investment

- Automation: Despite a softer market, contractors can preemptively fill technology gaps that position them to more fully participate in the recovery. Updated project-management technologies such as building information modeling (BIM), as well as robotic process automation (RPA) to speed back-office processes are particularly important, as the Biden administration prepares for infrastructure investment and the creation of new construction opportunities. New technology also allows contractors who had struggled to find skilled labor prior to the pandemic the opportunity to better evaluate long-term labor needs.

WHY INVEST NOW?

In recent years, middle market firms have lagged their larger industry counterparts in capital outlays, a trend that has been documented in the RSM US Middle Market Business Index. In an encouraging sign, the December 2020 MMBI survey showed that more than half of respondents (52%) said they expect to boost investment in productivity-enhancing capital expenditures such as software, equipment and intellectual property over the next six months.

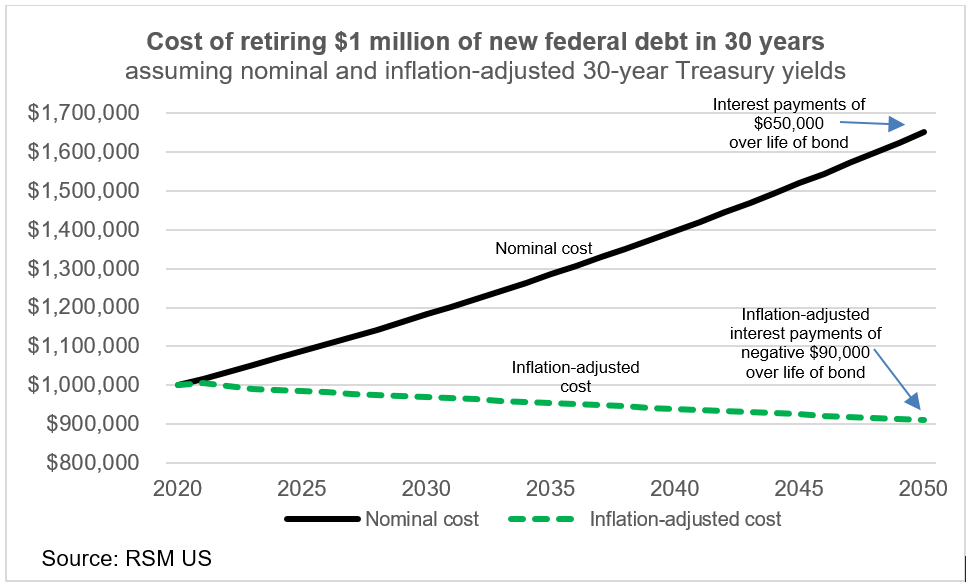

“Due to the unique confluence of events that is upon us,” writes Brusuelas, “firms will actually make money by borrowing, because we are operating at near-zero nominal interest rates that become negative when adjusted for inflation.”

Let's Talk!

Call us at +1 213.873.1700, email us at solutions@vasquezcpa.com or fill out the form below and we'll contact you to discuss your specific situation.

This article was written by Laura Dietzel, Troy Merkel, Scott Helberg, Nick Grandy, Ryan McAndrew and originally appeared on Feb 14, 2021.

2022 RSM US LLP. All rights reserved.

https://rsmus.com/insights/industries/real-estate/conditions-ripe-for-real-estate-construction-to-make-strategic-i.html

RSM US Alliance provides its members with access to resources of RSM US LLP. RSM US Alliance member firms are separate and independent businesses and legal entities that are responsible for their own acts and omissions, and each is separate and independent from RSM US LLP. RSM US LLP is the U.S. member firm of RSM International, a global network of independent audit, tax, and consulting firms. Members of RSM US Alliance have access to RSM International resources through RSM US LLP but are not member firms of RSM International. Visit rsmus.com/about us for more information regarding RSM US LLP and RSM International. The RSM logo is used under license by RSM US LLP. RSM US Alliance products and services are proprietary to RSM US LLP.

Vasquez & Company LLP is a proud member of the RSM US Alliance, a premier affiliation of independent accounting and consulting firms in the United States. RSM US Alliance provides our firm with access to resources of RSM US LLP, the leading provider of audit, tax and consulting services focused on the middle market. RSM US LLP is a licensed CPA firm and the U.S. member of RSM International, a global network of independent audit, tax and consulting firms with more than 43,000 people in over 120 countries.

Our membership in RSM US Alliance has elevated our capabilities in the marketplace, helping to differentiate our firm from the competition while allowing us to maintain our independence and entrepreneurial culture. We have access to a valuable peer network of like-sized firms as well as a broad range of tools, expertise and technical resources.

For more information on how Vasquez & Company LLP can assist you, please call +1 213.873.1700.

Subscribe to receive important updates from our Insights and Resources.